How Much Are Property Management Fees? And What's Reasonable?

October 15, 2019

Welcome Back to The Select Leasing & Management Blog!

Let’s discuss the elephant in the room: Many property owners reject the idea of hiring a property management company because they are afraid of the fees. They don’t just ask “How much are property management fees,” and then open their checkbook. They want to make sure they are getting the most out of their investment…and that the fees they are quoted are reasonable.

To understand what goes into property management fees structure, it helps to understand what fees typically cover (or should cover) and how to calculate their true value (which is your return on investment).

What Property Management Fees Cover

Different property management companies can offer different service packages, but there are some property management services that are pretty typical across the industry. These include:

- Tenant screening and background checks.

- Preparing units for rent.

- Drawing up the leases.

- Collecting rent and keeping accounts.

- Handling maintenance requests.

- Assisting with grounds (snow removal, lawn care, etc.).

- Compliance with state and local laws.

In addition, many companies offer one or more of these services as well:

- Marketing and advertising.

- Property evaluation.

- Property inspections.

- Policy consulting.

- Online portal (for paying rent, reporting maintenance issues, etc.).

The fees that a property management company charges, then, cover the labor and materials for these services, including the technology needed to report to you every month.

Select Leasing and Management’s Fees

All that said, the fees that management companies charge can vary wildly. Most charge a portion of the rent you collect, though some might have a flat-fee or sliding scale. Because there is so much variation, we’ll simply hold out our own company as an example.

The fee structure for management services here at Select Leasing and Management is simple, by design. We charge 10 percent of the monthly rent. So what you pay depends on how much rent your property earns. This way, our fee scales with the number of properties managed and what kind of rental rates you can manage to charge for them, guaranteeing that you’ll get a predictable (and fair) share of the income.

Beware of Up-Charges and Hidden Fees

We are also proud that we do not charge “special fees” for services that are by-demand (and not monthly). For example, suppose a tenant calls in the middle of the night with an emergency that needs a response right away. Some management companies consider this an “additional” service, and so an extra fee appears on your bill at the end of the month—and it can be an exorbitant one.

A more responsible pricing model makes reasonable predictions about these kinds of events and builds them into the pricing. While this might make your fees look higher initially, you actually save in the long run, due to that kind of careful planning.

Return on Investment (ROI) of Property Management Services

You shouldn’t just look at management fees as an extra expense, however. Fees for property management are an investment. Let us explain:

Getting the most out of your property requires good tenants and happy tenants. Good tenants pay their rent on time and tend to take good care of your property, whereas bad tenants might stiff you on rent, damage the property, or even cost you money to process an eviction.

Likewise, happy tenants will tend to stay where they are, happily renewing their lease and perhaps even recommending your property to others when there is a vacancy. Unhappy tenants do not do this.

We can use these facts to think about the expenses that you incur with bad or unhappy tenants, and that you avoid with good, happy ones:

- Cost of carrying a vacant property

- Turnover costs (cleaning fees, inspections, customer background checks, etc.)

- Repair costs (commonly repairs in floors and walls, plumbing, electrical, and appliances)

- Added maintenance costs

- Marketing and advertising costs

- Interest lost due to delinquent rent

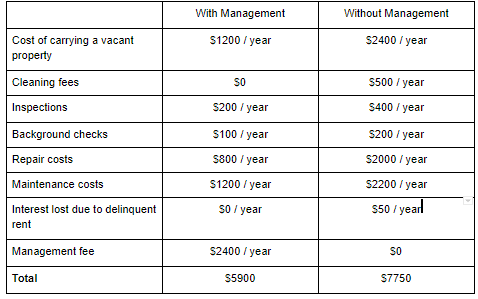

To calculate your return on investment, calculate each of these costs 1) without proper management, and 2) with management, plus the fee. Here’s a sample calculation:

In this case, it’s pretty clear that using property management saves money over not using it. But by how much?

Simply subtract the total cost of management from the cost of maintaining the property without management, then divide by the management fee. Here, that’s:

$7750 - $5900 / $2400

Which is $1850/$2400, or about 77 percent return on your investment. Just for comparison, the stock market has an average return of about 15 percent and doesn’t even top 22 percent in a good year.

Understanding Your Property Management Fees

Of course, the above are just sample numbers to play with. You will need to do some research to figure out your own costs, Then do your calculation. You can use our fee structure to see what is, or is not, worthwhile for you as a property owner.

And if your property happens to be in the St. Louis area, go ahead and contact us. We want to make your property, and our management of it, a worthwhile investment for you.

raph

Share this post

Rental property emergencies can take many forms, from nuisances like burst water pipes to life-threatening fires or natural disasters. Regardless of the severity of the emergency, landlords must be prepared to respond quickly and decisively to ensure tenant safety and to minimize property damage. Emergency preparedness for landlords who self-manage their rentals can be a daunting task. Entrusting a property management company instead is the perfect solution for landlords who are overwhelmed by the prospect. These professionals have the expertise to anticipate a variety of scenarios, plan and organize resources, and know what to do if and when a crisis arises. Here’s how they do it.